What are Wise Payouts?

Wise Payouts is a new feature that allows you to automatically pay your affiliates directly to their bank accounts using Wise’s international money transfer service.

This eliminates the need for manual bank transfers and provides a seamless way to pay affiliates worldwide with low fees and competitive exchange rates.

Key Benefits

- Automatic Payments: Send money directly to affiliate bank accounts with just a few clicks.

- International Support: Pay affiliates in over 50 countries worldwide.

- Low Fees: Wise offers competitive rates for international transfers.

- Multiple Currencies: Automatically handles currency conversion when needed.

- No Recipient Account Required: Affiliates don’t need a Wise account to receive payments.

- Secure: Uses Wise’s secure banking infrastructure with proper authentication.

Getting Started

Prerequisites

Before you can use Wise Payouts, you’ll need:

- A Wise Business Account: Sign up at wise.com for a business account.

- API Access: Request API access from Wise for your business account.

- Sufficient Funds: Ensure your Wise account has enough money to cover payouts.

Setting Up Wise Payouts

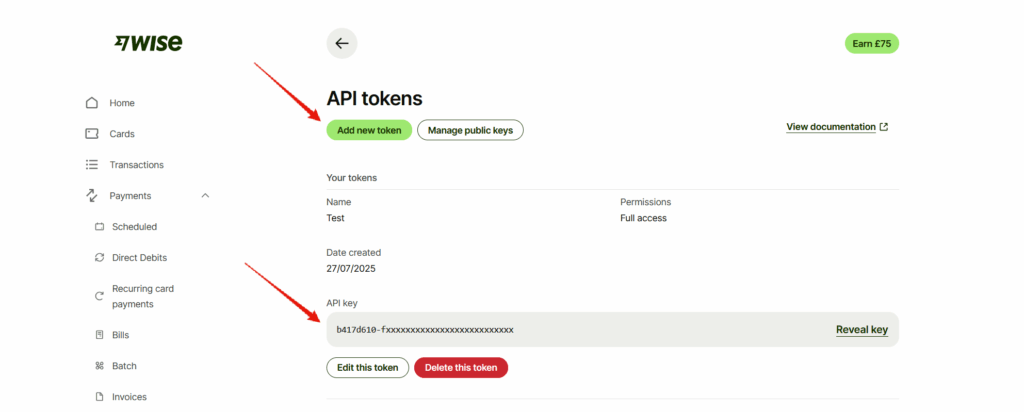

Get Your API Credentials:

- Log into your Wise business account.

- Navigate to the API section.

- Generate your API token and copy it.

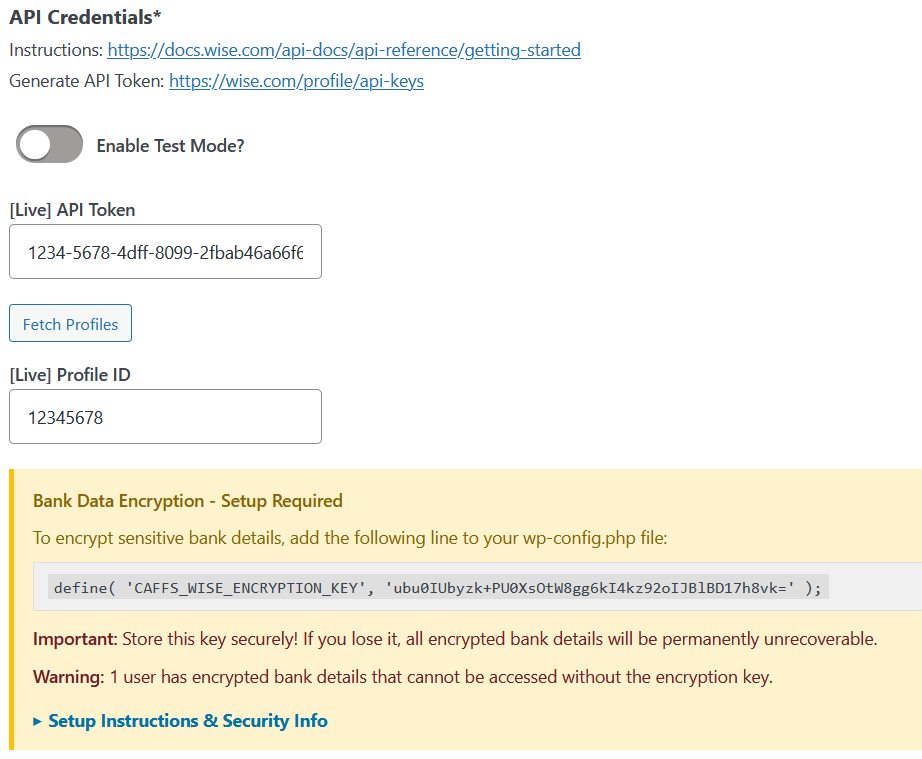

Configure Plugin Settings:

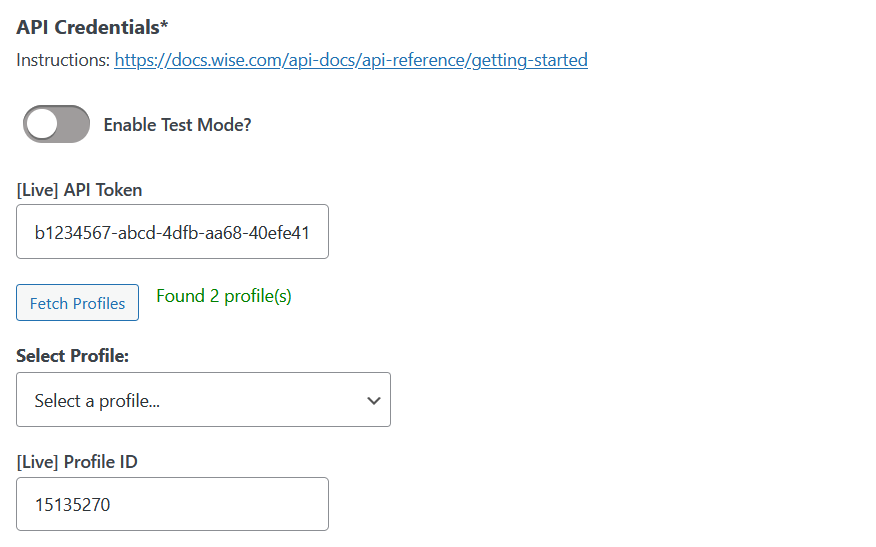

- Go to your WordPress admin area.

- Navigate to the plugin’s “Payouts” settings tab.

- Enable “Wise Bank Transfer Payouts”.

- Enter your API token.

- Click the “Fetch Profiles” button.

- Select your Wise Profile in the dropdown list, then the profile ID will be saved in the field below.

Test the Connection:

- Use test mode initially to ensure everything works.

- Process a small test payout to verify the setup.

How Affiliates Set Up Their Bank Details

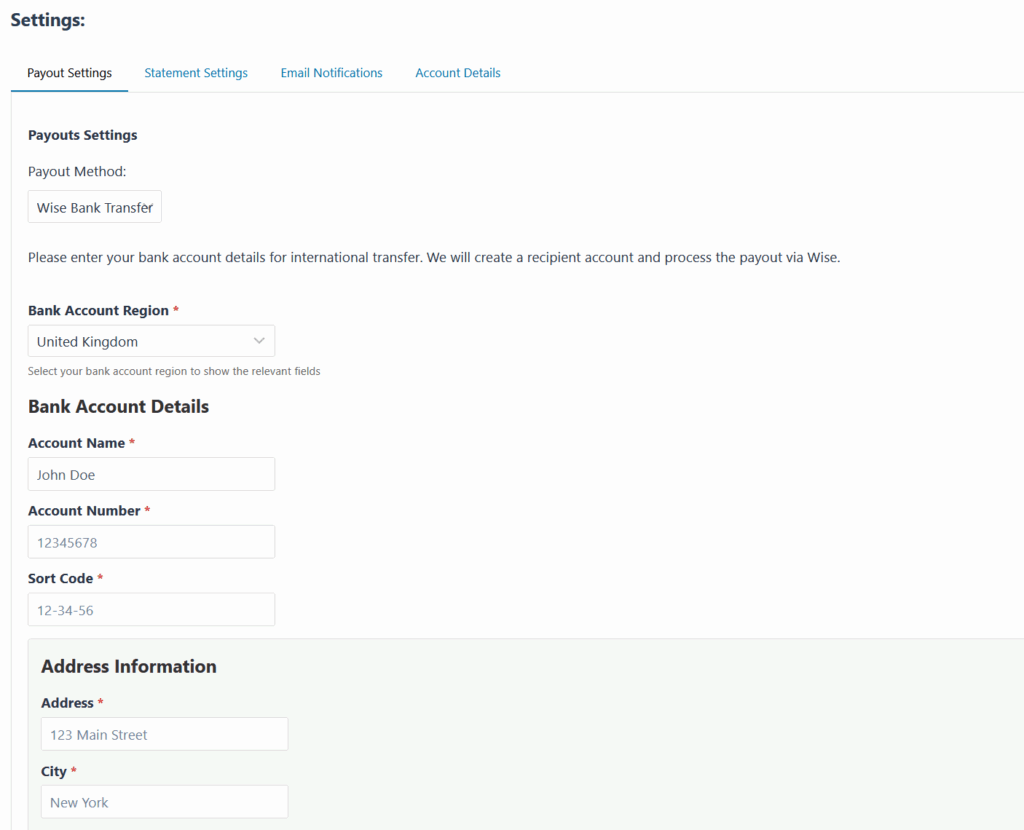

Affiliates can set their bank details in the “Settings” tab of their affiliate dashboard, in the “Payout Settings” tab.

They will first need to select their “Bank Account Region” which will then show the fields that are required specific to their region.

For Affiliates in the United States

Affiliates need to provide:

- Account Name: Full name as it appears on the bank account.

- Account Number: Their bank account number.

- Routing Number: The bank’s 9-digit ABA routing number.

- Account Type: Checking or Savings.

- Address Information: Complete address including state and ZIP code.

For Affiliates in the United Kingdom

Affiliates need to provide:

- Account Name: Full name as it appears on the bank account.

- Account Number: Their bank account number (usually 8 digits).

- Sort Code: The bank’s 6-digit sort code (format: 12-34-56).

- Address Information: Complete address including postal code.

For Affiliates in European Union Countries

Affiliates need to provide:

- Account Name: Full name as it appears on the bank account.

- IBAN: International Bank Account Number.

- Address Information: Complete address including postal code and country.

For International Affiliates (Other Countries)

Affiliates need to provide:

- Account Name: Full name as it appears on the bank account.

- Account Number: Their bank account number.

- SWIFT/BIC Code: The bank’s international identifier.

- Bank Name: Name of the bank.

- Bank Address: Bank’s physical address.

- Address Information: Complete recipient address.

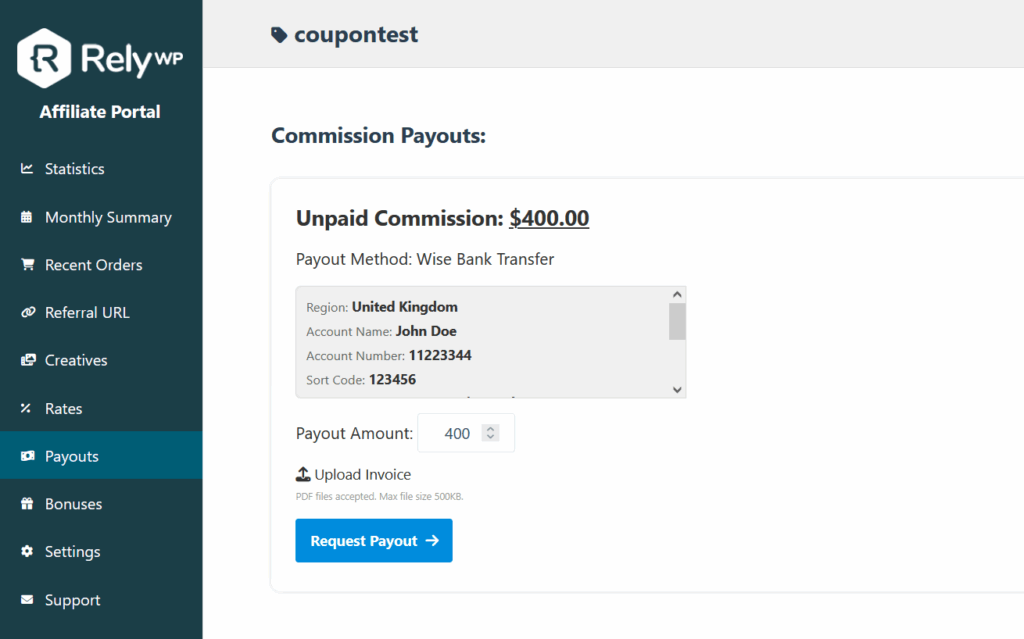

How Affiliates Request Payouts

Affiliates can request payouts just like any other payout method by going to the “Payouts” tab on the affiliate dashboard, and clicking the “Request Payout” button.

How to Process Payouts

Automatic Processing

- Navigate to the admin “Payouts” page.

- Find the affiliate payout request that you want to pay.

- Click “Pay via Wise Bank” button.

- The system will automatically:

- Create a transfer in your Wise account.

- Update the payout status to “created”.

Verify and Complete Payment

Next you will need to complete verification of the payment and complete it if needed within wise.

- Click the “Complete Payment in Wise” button.

- Verify and complete the payment within Wise.

- Go back to the “Payouts” page and click the “Mark as Paid” button.

Understanding Payout Statuses

- Pending: Payout has been requested but not yet processed.

- Created: Transfer has been created in Wise but requires completion.

- Paid: Payment has been successfully sent and completed.

- Cancelled: Payment was cancelled and commission returned to affiliate.

Fees and Currency Conversion

How Fees Work

- Wise charges fees based on the transfer amount and destination country.

- Fees are typically much lower than traditional bank transfers.

- The exact fee is shown before confirming each transfer and you can view a breakdown of Wise fees on their website.

Currency Conversion

- If your store currency differs from the affiliate’s bank currency, Wise automatically converts it.

- Wise uses the real exchange rate (mid-market rate).

- Conversion fees are transparent and competitive.

Security and Compliance

Bank Data Encryption & Security

For enhanced security, sensitive banking information (account numbers, routing numbers, SWIFT codes, IBANs, and sort codes) can be encrypted before being stored in your WordPress database.

Setting Up Encryption:

To enable custom encryption, add this line to your wp-config.php file with a random 32 characters long key string.

define( 'CAFFS_WISE_ENCRYPTION_KEY', 'your-random-key-here' );In the settings page of the plugin, it will provide instructions along with a pre-generated key for you with the line of code to copy.

Important Security Notes:

- Your encryption key should be exactly 32 characters long. You can view the line above generated for you with a valid key in the Wise Payouts settings page.

- Store your key securely and never share it.

- Back up your key – if lost, encrypted data becomes permanently unrecoverable and affiliates may need to re-enter their bank details.

- Changing the key makes existing encrypted data inaccessible.

- Non-sensitive information (names, addresses) remains unencrypted for operational efficiency.

The encryption system automatically handles data protection without affecting the user experience, ensuring your affiliate banking information is more secure.

Troubleshooting Common Issues

Transfer Requires Manual Completion

Problem: Message says “requires Strong Customer Authentication”

Solution: Log into your Wise account and approve the transfer manually.

Insufficient Funds Error

Problem: “Insufficient funds in your Wise account”

Solution: Add money to your Wise account and complete the transfer.

Invalid Bank Details

Problem: Error about incorrect account information

Solution: Ask the affiliate to double-check their bank details, especially:

- Account numbers (no spaces or special characters)

- IBAN format for EU countries

- Sort code format for UK (xx-xx-xx)

- Routing numbers for US (9 digits)

Currency Not Supported

Problem: Error about unsupported currency

Solution: Check Wise’s supported currencies list or use a different payout method.

Best Practices

For Administrators

- Verify Details: Double-check affiliate bank details before processing.

- Monitor Balances: Keep sufficient funds in your Wise account.

- Regular Reconciliation: Match plugin records with Wise account statements.

For Affiliates

- Accurate Information: Provide exact bank details as they appear on statements.

- Complete Address: Include all required address fields.

- Keep Updated: Notify admin if bank details change.

- Verify Payments: Check bank statements to confirm receipt.

Conclusion

Wise Payouts streamlines the affiliate payment process by automating bank transfers worldwide. With proper setup and understanding of the requirements, you can efficiently pay affiliates while minimizing fees and administrative overhead. The system handles most payments automatically, with clear guidance when manual intervention is needed.